THIS BROKER HAS CLOSED AND IS NO LONGER AVAILABLE

___

How to Place a Pairs Trade on GOptions

One of our favorite recommended brokers, GOptions, has just added a new type of trading called pairs trading. One of our other recent articles discusses pairs trading in-depth. You can also learn more about trading pairs on our StockPair review. StockPair was the first broker to introduce this type of trading. They built quite a reputation around it, and since then other brokers have followed.

Pairs trading allows you to profit based on the relative performance of two assets. That means you are not concerned with whether the price of either is going up or down or by how much—just by whether one of them is outperforming the other, even if they are both rising or falling. Ever wake up one day and read the news and feel certain that Microsoft is going to outperform Apple today? Or that the price of gold will be higher than the price of silver? Now you can profit from those gut feelings (or lose—all trading carries risk!).

Let’s go over how to place a pairs trade on GOptions. In this article, I am just going to teach you step by step how to execute a trade on the platform. This is not an in-depth article on pairs strategy. Learning how to trade profitably is much more challenging than learning how to execute a trade. If you want to learn how to trade pairs profitably over the long term, you will need to learn a trading method.

Steps to Placing a Pairs Trade

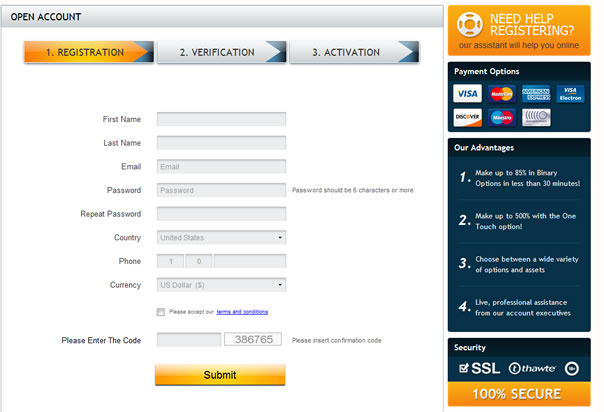

- First off, if you do not already have an account on GOptions, you will need to open one. Click the large yellow “Register Now” button at the top right of the website. You’ll be asked for basic information like your first and last name, your email, your country, your phone number, a password, and an account currency. If you already have an account, login instead.

- Fund your account if you haven’t already. GOptions offers a number of different methods for depositing money in your account.

- Now go to the “Trade Now” screen. Select “Pairs” from the far right. This will take you to the pairs trading screen and show you the current opportunities for trading.

- Scan through the asset pairs and see if you can find one that you can predict based on whatever method or strategy you are using (if you are gambling, maybe it is just your gut instinct).

- Select an expiry time (if you are given options).

- Enter in the amount of money you want to invest. Always calculate how much money to invest based on risk, not reward. The screen will show you if there is going to be an out-of-money reward, under “Protected Amount.” Factor this into your risk calculation. You will also see the payout percentage, and the calculated potential payout based on your input.

- Choose which asset you believe will outperform the other.

- Now all you have to do is wait for the trade to expire. On the graph, you can watch as price rises and falls, and you can also see which asset traders are favoring.

- When the clock runs out, and you reach the expiry period, your trade will expire in or out of the money. If the asset you chose is outperforming the other, you will win the payout which the platform listed. If on the other hand you lose your trade, because your asset underperformed relative to the other, you will lose your investment.

Example

As an example, imagine that you are on GOptions browsing for trade opportunities, and you find the asset pair Apple vs. Google. This is a binary options stock pair. If you have reason to believe that one stock will outperform the other within a particular timeframe, it may be worthwhile for you to place this trade.

On the news that morning, maybe you saw some negative press for Apple, and you believe that the negative press will impact the performance of their stock through the day. Perhaps Microsoft received some positive press that same day. You have every reason to believe that Microsoft’s stock will outperform Apple’s. Select the Apple vs. Google asset on your trading platform.

Look at the expiry time you see in the box to the right of the asset pair selection. Look at the options you are given and choose one that makes sense given the timing of the situation. For this particular trade, maybe you choose 17:00 (5:00 p.m. for all you traders in America), and right now, it is 15:00 (3:00 p.m.). By choosing this as your expiry time, you are wagering that Microsoft’s stock will outperform Apple’s stock by the time your trade ends in two hours.

Next you need to calculate how much money you can comfortably invest on your trade. Choose the amount you are using on each of your trades based on your money management plan (3% for example). If you have $500 in your account, that would be equal to $15.00. Below, you’ll be able to see the protected amount and the potential payout. If GOptions offers you an out-of-money reward (protected amount), you can increase the amount you wish to invest within your 3% limit. Above that, you’ll see the potential payout based on the percentage, given to you beside that. So if the payout percentage on this trade was 80%, you would win $12.

Now you wait for the trade to expire. If at 17:00 hours, Microsoft’s stock is outperforming Apple’s, no matter what else happened (if both stocks went down, that is irrelevant, so long as Microsoft’s is still performing above Apple’s), you win your trade, and you receive the payout percentage. So in this case, you would win $12. Otherwise, if Apple is performing better than Microsoft, you lose your investment. If there is any out-of-money reward, that amount (usually 0-15%) will be returned to you.

Why This Is Exciting

With pairs trading, you can profit based on very specific knowledge about two assets. You don’t have to know whether the market is going up or down, whether a particular sector is doing well in general, or even whether there is going to be a large move or a small one. All you have to know is whether a particular asset is likely to outperform another. In the example above, you didn’t need to know anything about whether the tech sector was healthy or not. You didn’t need to know whether the stock market was bullish or bearish. You didn’t even have to know whether either stock was likely to make a large move. All you had to know was how the two stocks would perform relative to one another. That much you could predict based off of the news you saw earlier in the day.

A Note on Money Management

You might have noticed the numbers discussed in the example on Microsoft and Apple were not particularly exciting. A chance to win $12? “But that’s nothing,” you were probably thinking. “I make more than that in an hour right now. Why should I put all that effort into winning $12? Isn’t that a waste of my time?”

I chose those numbers on purpose, as a deliberate reminder of what it means to manage money intelligently. When you only have $500 in your account, a reasonable percentage does not calculate out to much at all. This is not as important if you are trading just for fun, but it is critical if you are investing in the hopes of becoming a professional trader. Even if you are just playing for fun, though, remember, the larger the percentage you invest, the fewer trades you can make before you blow through your bankroll. You always have the option of depositing more money into your account if you can afford that. If you do learn how to profit consistently and reliably, things will go slowly at first, but eventually the exponential growth in your account will translate into incredible profits!